Your most valuable asset – is it insured?

I’ve just been speaking with a client about insurance and they couldn’t see the importance of having Income Protection Insurance – even though it is tax deductible! Let’s go back to the conversation we had in the meeting ….

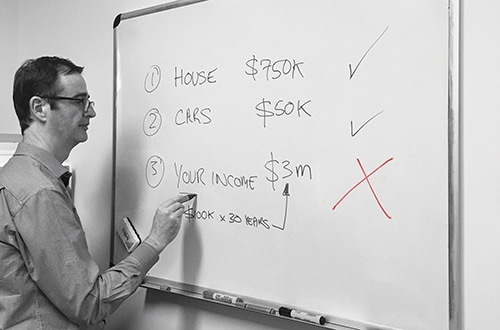

Standing at the whiteboard, I asked them “What is your most valuable asset?” Their response was ‘their home’ so I wrote this on the whiteboard and the current value of about $750k. I then asked them if it was insured – of course it was! Then we noted their cars, worth about $50k and they confirmed these too were insured.

When I then asked “Anything else?” they couldn’t think of anything significant.

I said to Greg, “What about your income? You earn about $100k each year and being aged 35 have at least another potential 30 years to work, yes? Even in today’s dollars, this is an asset worth $3m and it’s not insured! You think nothing of insuring a $30k car but your most valuable asset worth $3m isn’t insured!”

“What would happen to you, Jane and the kids if you were unable to work?” I asked.

Greg commented that this was a ‘light bulb’ moment for him. If he couldn’t work, he wouldn’t be able to keep their family home he & Jane had worked so hard for and their children couldn’t enjoy the lifestyle they’ve worked hard to offer them.

It’s only natural that we feel some discomfort about paying insurance premiums, even if they are tax deductible. However, a little discomfort is far better than a tonne of regret if something terrible happens and you aren’t covered.

Needless to say, Greg & Jane have taken action and implemented our advice. They now have great comfort & peace of mind knowing that they have in place a tailored insurance solution that covers them for Life, Total & Permanent Disablement, Trauma & of course Income Protection.

To minimise the impact on their cashflow, we have funded some of it via their super funds and Greg will also get a nice tax deduction this coming July.

Whilst they were concerned about running down their super balance, I explained that once they get their mortgage more under control we can make some additional contributions to super that will not only get it back on track but also save them further tax!

Hopefully this too may be your ‘light bulb’ moment. Please feel free to call me on 5990 1000 for an initial discussion, and get the peace of mind that comes with tailored personal insurance solutions.

Bruce Chisholm

Principal & Financial Planner – Cranbourne Highview Wealth Solutions T/AS Highview Accounting & Financial Authorised Representatives of InterPrac Financial Planning AFSL no. 246638.

NOTE: Names in the article have been changed to protect client privacy.