The new Commercial & Industrial Property Tax.

The Victorian Government is making a change to help businesses grow by getting rid of stamp duty on commercial and industrial properties. Instead, they’ll introduce a new Commercial and Industrial Property Tax (CIPT) starting from 1 July 2024.

Associate Partner, Matthew Lazzaro has prepared a breakdown of these changes and how they can impact you.

The new CIPT reform was developed to support businesses in Victoria, making it easier for them to start up, invest in new land and buildings, and create more jobs.

When is the new tax payable?

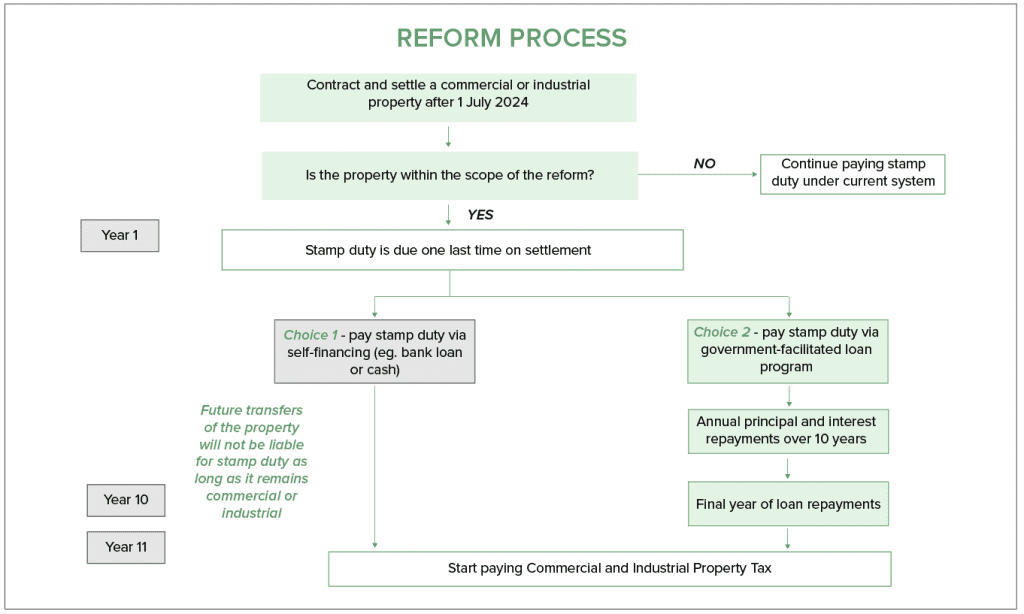

From 1 July 2024, you’ll only have to pay stamp duty once more on commercial and industrial properties, with no stamp duty on any future sales of those properties. After the next sale, a 1% flat rate property tax will kick in 10 years later based on the property’s land value without any improvements.

If you’re eligible, you can choose to get a government loan to cover the final stamp duty payment, so you don’t have to pay a big lump sum upfront. This will give you more cash to invest in your business and hire more employees.

The Victorian Government will provide educational support to help industry and taxpayers transition to the new scheme.

Qualifying commercial or industrial use

The new CIPT will generally apply to a property where:

- The contract of sale is signed (or landholder duty event happens) on or after 1 July 2024

- The property is used for commercial or industrial’ purposes at the time of settlement

- The transaction involves 50% or more ownership interest in the property (or combined with other interests in certain circumstances)

- The transaction is not exempt from duty or eligible for certain concessions

What will the new CIPT look like?

Below is a visual representation of how the CIPT process will work, along with an example.

Case Study Example – Entry into the tax reform system (first transaction)

Emma buys a commercial property on 25 September 2024 to set up her business. This transaction will trigger entry of that property into the reform (as it was contracted and settled on or after 1 July 2024).

At this point Emma can choose to pay stamp duty upfront or opt for a transition loan to pay the stamp duty, reducing her upfront costs.

If Emma’s property is in a regional area, she will receive a 50 per cent discount on her stamp duty through the regional commercial and industrial stamp duty concession.

The CIPT will commence 10 years after her purchase in 2035.

The CIPT changes will have a significant impact on commercial and industrial properties, and it is crucial to consider the potential implications of the this tax moving forward. There are various complex scenarios contributing to if the CIPT may or may not be applicable, so it is important to speak to a professional for further clarification. Reach out to our Accounting Team who can assist you with any queries.

Article written by Matt Lazzaro, Associate Partner & CPA

Highview Accounting & Financial – Cranbourne