Super & Salary Sacrificing

Let our expert Accountant Carlia tell you more about the importance of superannuation and salary sacrificing…

As you head into your elder years, you may hear talk about salary sacrificing, retirement and superannuation. What does all this talk mean for you?

What is super & who pays it?

Super is putting money aside for your retirement.

You can make personal superannuation contributions into your super fund, or your employer is legally required to make minimum superannuation contributions (currently 9.50% from 1 July 2014).

What types of contributions are there?

There are 2 types of contributions – concessional and non-concessional.

Concessional contributions are made using pre tax income that is paid into a super fund and is then taxed at 15% within the super fund. These contributions can come from your employer’s super guarantee payments or additional super you wish to contribute under a salary sacrifice agreement.

Concessional contributions have an annual limit of $25,000 per year ($35,000 if you are aged 59 or older on 30 June 2013). This means you can contribute a maximum of $25,000 (or $35,000) per year into superannuation, which is only taxed at 15%.

Non – Concessional contributions are made using post tax income and is paid into your super fund. This is not taxed within the fund as it came from after tax income. This type of contributions can be personal contributions or made directly from your employer using your post tax income.

What is salary sacrificing?

Salary sacrificing is simply when an employee forgoes receiving part of their salary in return for additional contributions made to superannuation on their behalf by their employer.

Example:

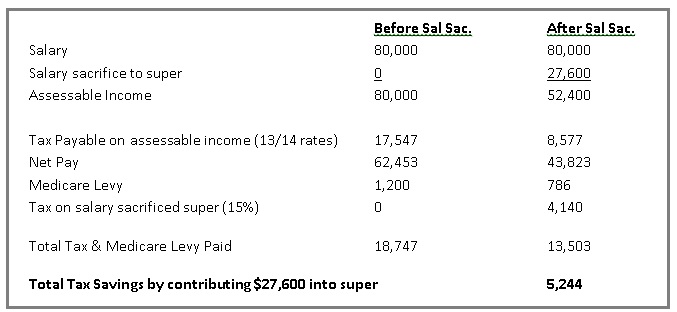

Mary is 60, receiving a salary of $80,000 in the 2013/2014 financial year. She wants to know her tax savings if she salary sacrifices $27,600 into super.

What this means for you?

Salary sacrificing is a common strategy used for individuals thinking of ways to get more money into super ready for their retirement.

This is therefore increasing their superannuation balance, and saving them money in tax!

This strategy is also used frequently for those wishing to inject more into super, roll their current fund into a SMSF and use this to buy investments such as investment properties within their own SMSF.

*Source – Peter Kelly, Centrepoint Alliance

If you’d like to speak with Carlia, or any of our knowledgable accountants please contact our office and make an appointment T: 5990 1000.