Inside the 2025/26 Australian Federal Budget: A Quick Overview

As the dust settles from last months announcement, the 2025/26 Australian Federal Budget has officially been unveiled, offering a comprehensive blueprint for the government’s priorities in the year ahead. With a focus on financial recovery, the budget reflects the government’s strategy to navigate a delicate economic landscape.

In the wake of ongoing global economic pressures and local needs, this budget sets the stage for Australia’s economic outlook. In the following article, Simon Byers, Partner and CPA of our Prahran office, explores the key points and their likely impacts on individuals, businesses and superannuation.

Individuals

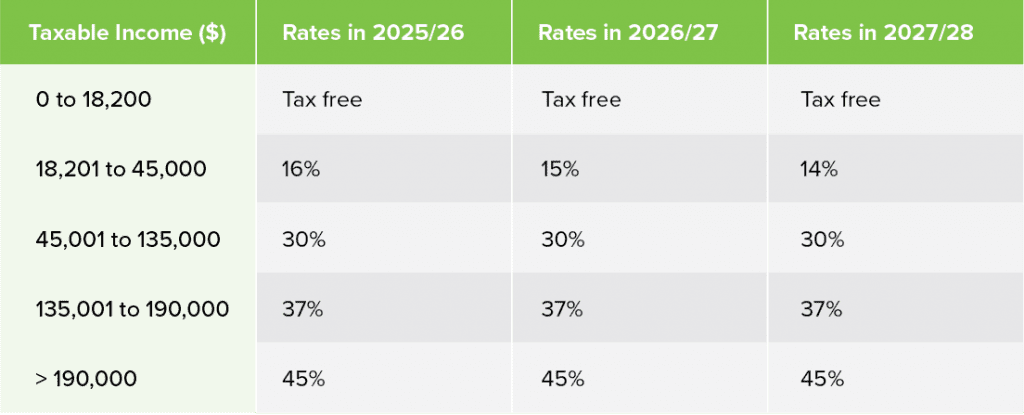

- The Government will deliver more tax cuts to all Australian taxpayers. Additional tax cuts for 2026 and 2027 sees the lowest rate continue to drop from the announced decrease in last years budget. The rate is currently at 16% then drops to 15% on the 1st July 2026 and then 14% on the 1st July 2027.

- A cost of living relief package was announced for eligible households and businesses that included a $75 per quarter rebate in each of the September and December 2025 quarters.

***Warning*** There is additional ATO funding targeting personal income tax compliance of $75.7m over the next four years from 1 July 2025 to extend and expand the Australian Taxation Office’s ‘Personal Income Tax Compliance Program’. This adds even further resources to combat key areas of non-compliance. The ATO’s areas of focus may include excessive or unusual work-related deductions, income not reported from the ‘gig’ economy and rental property expenses.

Businesses

Disappointingly there was not a lot in last nights budget for small businesses. There was no mention of an extension or expansion of the instant asset write off so you can expect depreciation to go back to traditional methods.

You may need to check your employee contracts as there was an announcement aiming to ban non-compete clauses in the contracts of staff earning less than $175,000.

As mentioned earlier, your business may be entitled to the $150 of energy rebates so keep an eye out for that detail.

Superannuation

- Payday super is set to proceed from 1st July 2026, so for those who pay super to employees this will need to be done at the time of paying the staff their net wages. If you receive super from your employer then it will just be coming earlier than it normally does.

- From 1st July this year, the Superannuation Guarantee rate is set to increase from the current 11.5% to 12%. This is the final increase to the Superannuation Guarantee rate based on previous legislation.

As always, if you have anything that concerns you regarding the new Budget, or need further clarification, please reach out to your trusted Highview expert.

Simon Byers

Partner & CPA

Highview Accounting & Financial, Prahran