Farewell to the Low and Middle Income Tax Offset.

It’s not great news for Individual Income Tax Returns this tax time, with the Low and Middle Income Tax Offset (LMITO) ending on 30 June 2023. This change will affect over 10 million Australian low to middle income earners, increasing their tax burden. What this means is an individual’s tax refund from July 2023 will be reduced by up to $1,500 in comparison to what was received in their 2022 tax refund. Unfortunately, this comes at a time when many are facing rising living expenses such as mortgage rates, rent, and other expenses. Ouch.

The LMITO ceases from 30 June 2023 and is being fully replaced by the Low Income Tax Offset (LITO). Let’s provide a little more detail on this remaining offset…

Low Income Tax Offset (LITO) remains unchanged – however only a very small percentage of Australians are eligible for this offset.

While the LMITO ends, low and middle income taxpayers remain entitled to the Low Income Tax Offset (LITO). No changes were made to the LITO in the 2023–2024 Budget, and so it will continue to apply for the 2023–2024 income year and beyond.

The LITO was intended to replace both the former Low Income and Low and Middle Income Tax Offsets from 2022–2023, but the new LITO was brought forward in the 2020 Budget to apply from the 2020–2021 income year.

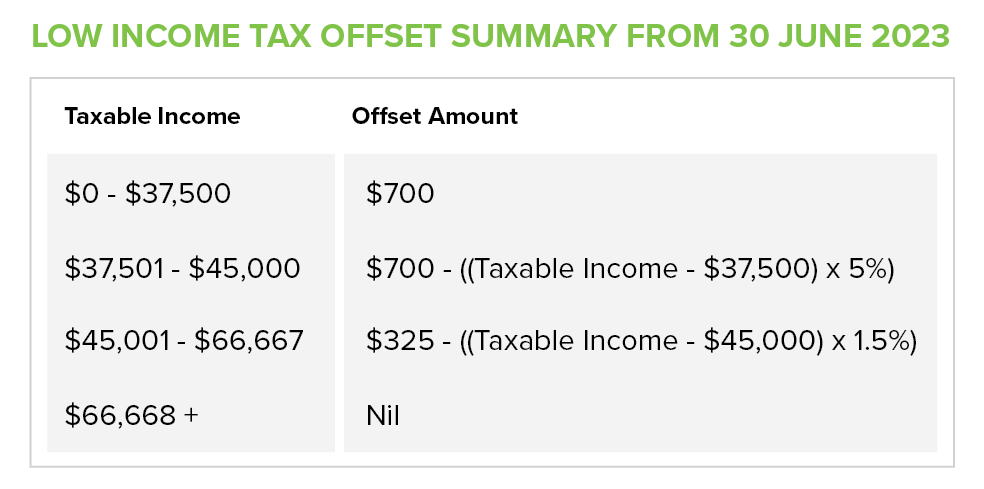

The maximum amount of the LITO is $700. The LITO is withdrawn at a rate of 5 cents per dollar between taxable incomes of $37,500 and $45,000 and then at a rate of 1.5 cents per dollar between taxable incomes of $45,000 and $66,667.

So, therefore many low to middle income earners will see their tax refunds for the 2023 financial year and beyond reduce by between $675 and $1,500 – as they won’t meet the LITO eligibility!

For more information about the LITO, please visit the ATO website here. Or speak with your Highview Accountant this tax time – we’re here to help!

Source: www.ato.gov.au

Source: https://budget.gov.au/