COVID-19 has presented first home buyers with a unique opportunity.

First-home buyers hugely benefit from stamp duty exemptions as well as other government concessions this 2020.

In a bid to boost the property market amidst the COVID-19 pandemic, the government is granting stamp duty concessions that could potentially save first home buyers thousands of dollars.

In NSW for example, first-home buyers are exempt from paying stamp duty on newly built homes with value up to $650,000. Starting 1 August running for 12 months, NSW stamp duty exemption will jump from $650,000 to $800,000 with decreasing discounts for properties valued up to $1 million.

Stamp Duty for NSW will also temporarily freeze for vacant land valued up to $400,000 of first-home buyers.

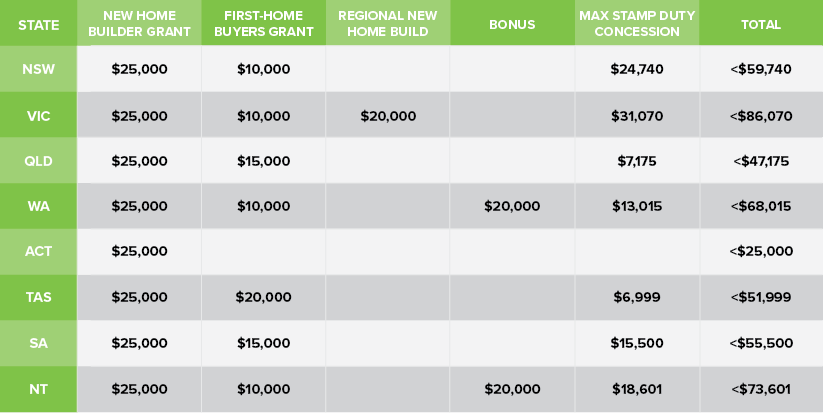

If you’re a first home buyer, there are also other government concessions that you can take advantage of, aside from stamp duty exemption. The table below highlights other government concessions that are available for first home buyers.

The stamp duty changes could bring first homebuyers savings of up to $31,335 and about $70,000 in total from all government assistance.

If you’re a first home buyer, you’d be happy to know that aside from government assistance, banks are also offering interest rates as low as 2.19 per cent.

A national lender is, in fact, waiving up to $10k in mortgage insurance. First home buyers borrowing up to 85 per cent of a property could potentially save up to $10,540.

All these have made owning a home easier for Australians. Indeed, the government estimates about 6000 first home buyers will benefit and will get into the property market this year.

Now may just be the best time to buy that first home.

If you’re a

Victorian first home buyer visit the SRO here, to view

what help is available to you and the application processes.

Source: James MacSmith author for realestate.com.au, State Revenue Office Victoria www.sro.vic.gov.au