2024-25 FEDERAL BUDGET ANNOUNCED – Let’s unpack the details.

A little bit of relief, a lot of restraint and not much reform was delivered in Jim Chalmers’ 2024-25 Federal Budget. Simon Byers, Partner and CPA of our Prahran office has reviewed the nitty gritty details to provide a summary of the key changes announced that will affect individuals, businesses and superannuation.

Chalmers is in the tough position of trying to provide some cost-of-living relief to those that are struggling, without driving inflation further up. The Government announced a $9.3b surplus this year off the back of generous company tax receipts – a pleasant surprise after the $1.3b deficit forecasted in the Mid-Year Outlook presented in December 2023.

Businesses and individuals have been put on notice that the ATO’s review, audit and taskforce programs are here to stay. There will be increased funding over longer periods to boost tax collections from individuals overclaiming deductions, right through to multinationals with complex affairs. Warning noted!

Let’s unpack some key points announced that will affect individuals, businesses, and superannuation.

Individuals

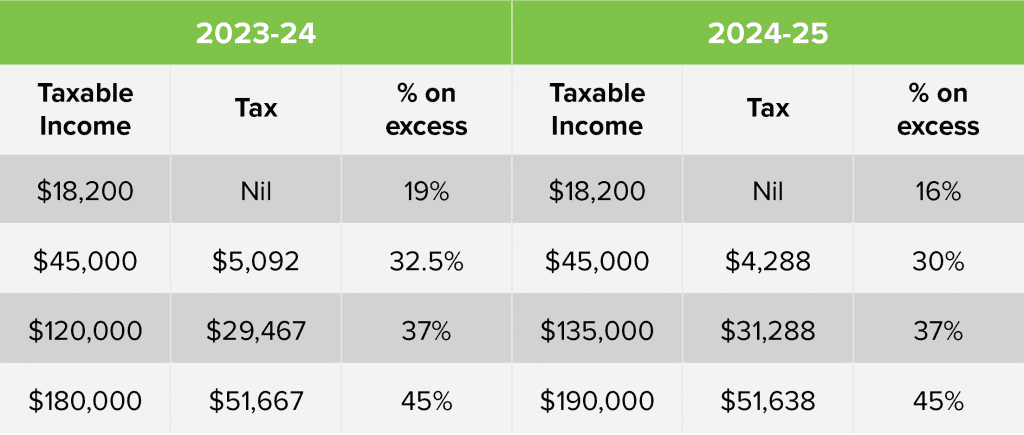

- As previously announced, from 1 July 2024, 13.6 million taxpayers will receive a permanent tax cut. The new rates for 2024/25 are presented below:

- $300 for each household in the form of electricity bill rebates will be granted, taking some pressure off rising utility bills.

- There will be increases to the Medicare levy low-income thresholds.

- HELP Debt relief will be actioned, with changes to how the indexation is calculated, and backdating these payments has been approved from 1 July 2023, reducing student debt by $3 billion.

Businesses

- To improve cash flow and reduce compliance costs for eligible small businesses, the instant asset write-off has been extended for a further 12 months, but only for individual assets that are less than $20,000 and installed and ready for use by 30 June 2025.

- From 1 July 2024 small businesses will be eligible for a $325 electricity bill rebate.

- Free online training will be provided for eligible small businesses and their staff to help build cyber resilience. This includes a free online interactive health check to self-assess their cyber security maturity.

Superannuation

- From 1 July 2025, the Government will proceed with reducing the tax concessions available to individuals with a total super balance of over $3m. The measure proposes to apply an additional tax rate of 15% on the amount of earnings relating to the proportion of an individual’s total super balance that exceeds $3m.

- The Super Guarantee is set to continue to increase, going from 11% to 11.5% from 1 July 2024 and to 12% on the 1 July 2025.

- Contribution caps will increase from $27,500 to $30,000 for all individuals, regardless of age.

Get in touch – we’re here to help!

As always, if you have anything that concerns you regarding the new Budget, or need further clarification, please reach out to your trusted Highview expert.

We hope your 2024-25 financial year is a successful one that sees you tick off more of your financial goals.

Simon Byers

Partner & CPA

Highview Accounting & Financial, Prahran

Source: ATO Website here.