2022 Year in Review.

The year began on an optimistic note, as we finally began to emerge from COVID restrictions. Then Russia threw a curve ball that reverberated around the world and suddenly people who had never given a thought to the Reserve Bank were waiting with bated breath for its monthly interest rate announcements.

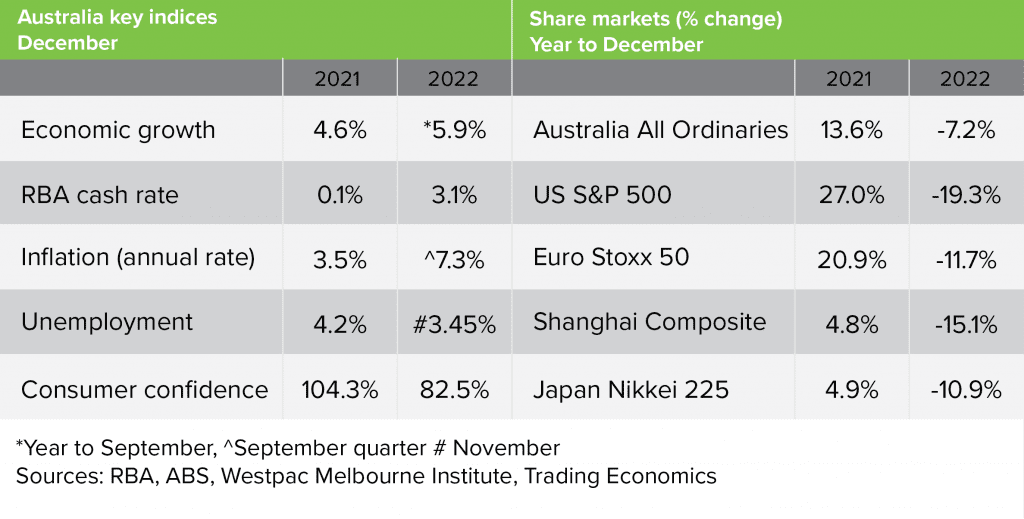

2022 was the year of rising interest rates to combat surging inflation, war in Ukraine and recession fears. These factors combined to create cost-of-living pressures for households and a downturn in share and bond markets.

Super funds also suffered their first calendar year loss since 2011.

Ratings group Chant West estimates the median growth fund fell about 4 per cent last year. While this is bad news for members, it’s worth remembering that super is a long-term investment, and that the median growth fund is still 11 per cent above its pre-COVID high of January 2020.

The big picture

Even though investors have come to expect unpredictable markets, nobody could have predicted what unfolded in 2022.

Russia’s invasion of Ukraine in February triggered a series of unfortunate events for the global economy and investment markets. It disrupted energy and food supplies, pushing up prices and inflation.

Inflation sits around 7 to 11 per cent in most advanced countries, with Australia and the US at the low end of that range and the Euro area at the higher end.

As a result, central banks began aggressively lifting interest rates to dampen demand and prevent a price and wages spiral.

Rising inflation and interest rates

The Reserve Bank of Australia (RBA) lifted rates eight times, taking the target cash rate from 0.1 per cent in May to 3.1 per cent in December. This quickly flowed through to mortgage interest rates, putting a dampener on consumer sentiment.

Australia remains in a better position than most, with unemployment below 3.5 per cent and wages growth of 3.1 per cent running well behind inflation.

Despite the geopolitical challenges, Australia’s economic growth increased to 5.9% in the September quarter before contracting to an estimated 3 per cent by year’s end, in line with most of our trading partners.

Volatile share markets

Share investors endured a nail-biting year, as markets wrestled with rising interest rates, inflation, and the war in Ukraine.

Global shares plunged in October on interest rate and recession anxiety only to snap back late in the year on hopes that interest rates may be near their peak. The US market led the way down, finishing 19 per cent lower, due to its exposure to high-tech stocks and the Federal Reserve’s aggressive interest rate hikes. Chinese shares (down 15 per cent) also had a tough time as strict COVID lockdowns shut down much of its economy.

Australian shares performed well by comparison, down just 7 per cent, thanks to strong commodity prices and the Reserve Bank’s relatively moderate interest rate hikes.

Energy and utilities stocks were strong due to the impact of the war in Ukraine on oil and gas prices. On the flip side, the worst performers were information technology, real estate and consumer discretionary stocks as consumers reacted to cost-of-living pressures.

Property slowdown

After peaking in May, national home values fell sharply as the Reserve Bank began ratcheting up interest rates. The CoreLogic home value index fell 5.3% in 2022, the first calendar year decline since the global financial crisis of 2008.

As always though, price movements were not uniform. Sydney (-12 per cent), Melbourne (-8 per cent) and prestige capital city properties generally led the downturn. Bucking the trend, prices continued to edge higher in Adelaide (up 10 per cent), Perth (3.6 per cent), Darwin (4.3 per cent) and many regional areas.

Rental returns outpaced home prices as high interest rates, demographic shifts and low vacancy rates pushed rents up 10.2 per cent in 2022. Gross yields recovered to pre-COVID levels rising to 3.78 per gent in December on a combination of strong rental growth and falling housing values. However it’s likely net yields fell as mortgage repayments increased

Despite the downturn, CoreLogic reports housing values generally remain above pre-COVID levels. At the end of December capital cities combined were still 11.7 per cent above their March 2020 levels, while regional markets were a massive 32.2 per cent higher.

Looking ahead

While the outlook for 2023 remains challenging, there are signs that inflation may have peaked and that central banks are nearing the end of their rate hikes.

Even so, the risk of recession is still high although less so in Australia where the RBA has been less aggressive in applying the interest rate brakes.

Issues for investors to watch out for in the year ahead are:

- A protracted conflict in Ukraine

- A new COVID wave in China which could further disrupt supply chains across the Australian economy, and

- Steeper than expected falls in Australian housing prices which could lead to forced sales and dampen consumer spending.

If you would like to discuss your investment strategy in the light at prevailing economic conditions, don’t hesitate to get in touch with our Financial Planners at Highview – we’re here to help!

Source: Accountants Private Advice by Akambo

Note: All share market figures are live prices as at 31 December 2022 sourced from: wwww.tradingeconomics.com/stocks

All property figures are sourced from: https://www.corelogic.com.au/news-research/news/2022/corelogic-home-value-index-australian-housing-values-down-5.3-over-2022